China has over the last two decades progressed to a market-driven system and developed its accounting and bookkeeping procedures more in-line with international standards. However, certain accounting and bookkeeping practices will still present new challenges and considerations for companies setting up in China.

Official VAT invoices (fapiao)

The official VAT invoice system – known locally as fapiaos – is a VAT anti-counterfeit measure developed and implemented by the Chinese tax authorities. Upon issuance, VAT fapiaos will record and share relevant sales data with the tax authorities including sales amount, tax amount, customer name, customer tax registration number, and the type and quantity of goods or service in question.

Two types of official VAT invoices exist. General VAT fapiaos can be used for qualified expense deductions for CIT purposes but cannot offset Input VAT on purchases against output VAT on sales. Special VAT fapiaos, on the other hand, allow for qualified expense deductions for CIT purposes as well as the input VAT amount to be deducted from the output VAT payable. As such, only a net VAT is collected by the tax authorities rather than the full gross amount.

A company is given a limited number of special VAT invoices they can issue within a given period and must request more if needed. Special VAT fapiaos must also include additional information such as customers bank account number, bank name, phone number, and registered address.

The tax authorities closely monitor the issuance of special VAT fapiao as this represents the main source of tax revenues for the government. With the implementation of the new Golden Tax System, the tax authorities are able to keep track of the upper and lower streams of the transaction to ensure VATs are properly calculated and paid to the relevant tax authorities on time. This makes tax evasion and the issuance of a “fake” fapiao virtually impossible to carry out.

China financial reporting requirements

The fiscal year for enterprises in China runs from January 1st to December 31st. Depending on the nature of the business activities, tax reports must be files either monthly, quarterly, or by transaction.

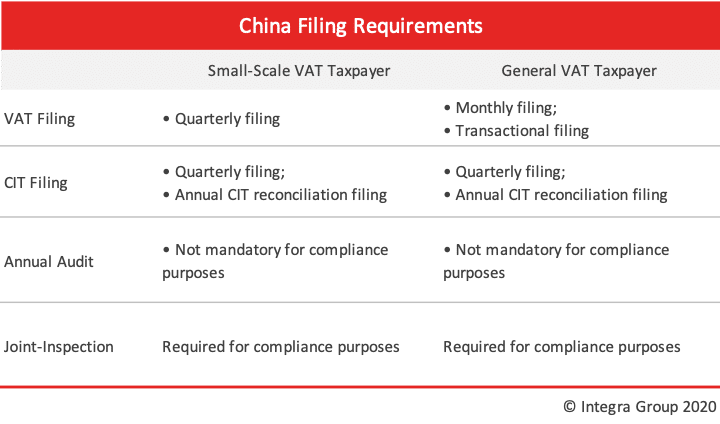

The below chart summarizes the tax filing requirement for enterprises in China based on their tax registration status:

Annual CIT return filing

In China, it’s common that accounting standards differ slightly from tax laws, often resulting in a difference in the CIT tax payable and the total profits of the companies as shown in the accounting records. The State Administration of Taxation (SAT) requires that all China resident enterprises submit an annual CIT return together with a reconciliation sheet before May 31st following the end of the fiscal year to ensure all tax liabilities have been met according to PRC tax law. Companies must either pay a tax shortage or claim a tax refund during this process.

Companies that meet specific conditions may also be required to submit a tax audit report prepared by a Certified Tax Agent in China for compliance purposes. The conditions vary between local jurisdictions and generally required if the company has incurred substantial tax losses year to date, applying for tax refunds or revenues have met certain thresholds.

Moreover, FIE’s that frequently engage in related party transactions and intercompany agreements are also required to file an Annual Related-Party Transaction Report and Transfer Pricing Documentation to assess the impact of the transactions in question on the company’s taxable income.

Annual joint inspection

FIEs in China are required to undergo an annual joint inspection by the MOFCOM, MOF, SAT, AQSIQ, NBS, and SAFE to serve the information collection requirements of each government department. In a joint announcement by the MOFCOM, Administration of Market Supervision, and SAFE [2019] No. 72 on January 3rd, 2020, the annual AIC filing and the joint inspection will be combined in a single report filed through the National Enterprise Credit Information Publicity System starting with the 2019 fiscal year.

FIE’s are required to submit the financial reports for the prior year and additional registration information, including;

- Information regarding the company registration status;

- Information regarding investments in establishing companies or equity purchases;

- Information regarding the paid-in capital in the case the company is a limited liability company or a company limited by shares;

- Information regarding change in equity or transfer of equity of company limited by shares;

- Information regarding the number of employees, total assets, total liabilities, total owners’ equity, total revenue, gross profit, net profit, total tax payable, and other financial information.

The Annual Joint Inspection report must be submitted online through the National Enterprise Credit Information Publicity System before June 30th of the following year.

Annual statutory audit report

Currently, an annual statutory audit report is not a mandatory requirement for all companies to meet regulatory compliances. However, if requested by relevant government authorities, the company must provide an audit report signed by a Certified Public Accountant in China. The following are several common scenarios that require the company to produce an annual audit report:

- The company records substantial tax losses cumulatively which jeopardize the continuity of the enterprise;

- The company intends to distribute after-tax earnings to shareholders in the form of dividends;

- Shareholders or trustees mandate an annual audit for internal monitoring purposes;

- The Company is looking for financing in which the lending party requires the latest audit financial report.

An annual statutory audit report in China includes an audit of the balance sheet, income statement, and cash flow statement. Auditors will express an opinion on whether the relevant financial statements fairly state the company’s financial position at year-end, operating performance, and it’s cash flow according to the China Accounting Standards (CAS).

China accounting standards

Accounting and bookkeeping practices in China are governed by the China Accounting Standards (CAS) – also known as the Generally Accepted Accounting Principles in China (PRC GAAP). The CAS framework consists of two standards:

Accounting Standards for Business Enterprises (ASBE); and

Accounting Standards for Small Business Enterprises (ASSBE).

Most Foreign Invested Enterprises use ASBE when preparing their annual financial reports – which are structured similarly to IFRS and US GAAP. The ASSBE uses the ASBE as a reference and is intended to make it easier for small businesses to follow accounting standards and tax laws. The tax calculation methods in the ASSBE are designed to be closer to tax laws, thus simplifying the process of making year-end adjustments.

The IFRS recognizes that the ASBE “substantially converge” with IFRS and in a roadmap published by the Ministry of Finance, Chinese authorities declared the ASBEs will be revised and improved in accordance with the revision and improvement of IFRS.

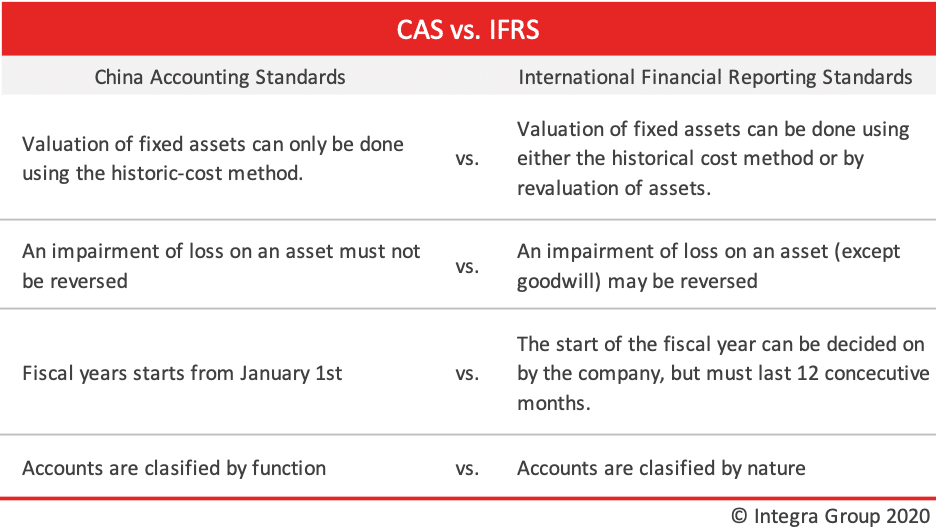

The chart below highlights some important discrepancies between CAS and IFRS.

There are several other minor discrepancies between CAS and IFRS in addition to those mentioned above. Both CAS and IFRS provide more detailed rules on some practices that are common in their relevant jurisdiction and only affect specific financial activities.

Converting CAS compliant financial reports

The issue of different accounting and financial reporting standards is most apparent when financial statements are provided to overseas companies. Group reporting is not possible without first converting the CAS compliant financial reports to the reporting standard of a specific jurisdiction.

The information on the Chinese financial reports must be converted to fit the reporting standards of the target jurisdiction, through a process called “mapping”. Accountants must first map the accounts on the financial reports to that of the target accounting standard. This is typically a one-time procedure.

Accountants also need to pay special attention to the differences in the accounting standards used in China and the standards of the target jurisdiction and identify any financial activities that may be affected. For most companies, this is a manual process. Large companies can develop specialized software to carry out this function in real-time based on their requirements.

Enterprises in China are encouraged to seek an accounting and tax professional for meeting their accounting and tax compliance requirements. If you have any concerns about the compliance status of your business or would simply like to improve on your compliance procedures, contact Integra Group for advice based on your individual circumstances.