Every year, the two main political bodies in China meet for the annual “Two Sessions”, where major economic, trade, diplomatic, and environmental policies are announced.

The Two Sessions consist of back-to-back meetings of the National People’s Congress (NPC), the highest legislative organ of the Chinese Communist Party (CCP), and the Chinese People’s Political Consultative Conference (CPPCC), an advisory board of over 2,200 politicians, businesspeople, social elites, and special invitees.

The annual Two Sessions is typically highlighted by the Premier delivering the Government Work Report (政府工作报告) which includes major policy announcements and governmental priorities for the following year.

However, this year’s annual Two Sessions, in particular, carries added importance, as the 14th 5-year plan together with the “Long-Term Objectives Through 2035” have been formally submitted to the conference. This year’s annual event also marking the 100th anniversary of the CCP which carries important symbolic value for policymakers.

Announcements at this year’s Two Sessions give Chinese businesses and foreign investors a clear window into the policy agenda and development reforms planned for years to come.

Notably, the Work Report delivered by Premier Li Keqiang provides short-term policy announcements which should come as good news to businesses in China.

Fiscal Policy Announcements in the 2021 Work Report

An area of the Government Work Report which is of great interest to businesses and foreign investors is the announcements on upcoming fiscal policy changes. Premier Li Keqiang delivered the 2021 Work Report which directs government departments to continue introducing structural tax reduction measures for enterprises in China and extend the effective period of certain preferential policies introduced in response to the COVID-19 epidemic.

Reduced VAT rate for small-scale taxpayers

In response to the COVID-19 pandemic, the State Taxation Administration and Ministry of Finance jointly announced that small-scale taxpayers nationwide would enjoy a reduced VAT rate of 1%, down from 3% (Caishui [2020] No. 13). As such, this policy was set to expire on December 31st, 2020.

Premier Li Keqiang announced in his readout of the 2021 government work report, that the reduced VAT rate for small-scale taxpayers would be extended. Taxpayers who are already enjoying the reduced VAT rate can expect to continue to enjoy the preferential rate throughout 2021.

Increased the ceiling for VAT exemption

In China, small-scale VAT taxpayers whose revenue does not exceed RMB 100,000 monthly (or RMB 300,000 quarterly) are eligible for VAT exemption status. Following announcements during the Two Sessions, the revenue ceiling for VAT exemption has been increased to RMB 150,000 monthly or RMB 450,000 on a quarterly basis.

Increasing the revenue ceiling for VAT exempt taxpayers results in more taxpayers enjoying the preferential policy and further reduces the tax burden for qualified small businesses in China. VAT exempted taxpayers are still required to submit a quarterly VAT filing, however, are not required to withhold and pay the VAT at the end of the filing period.

Halving CIT Liability for Micro and Small-sized Enterprises

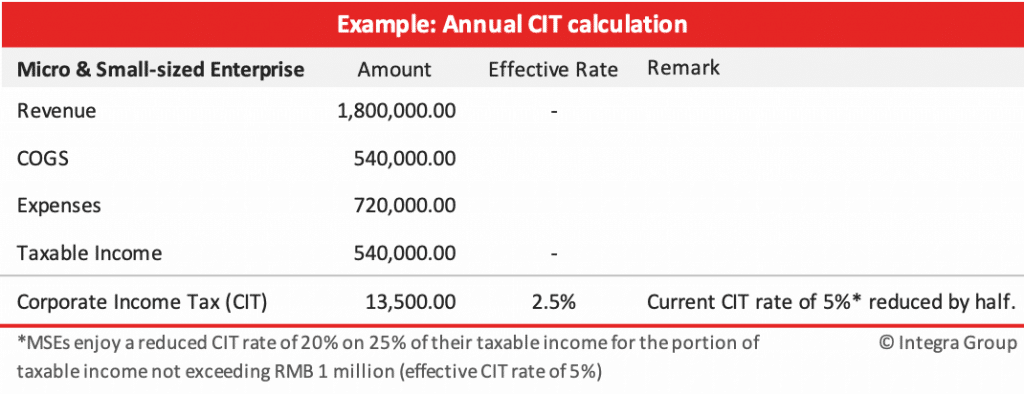

Currently, Micro and small-sized enterprises (MSE) enjoy a preferential CIT rate of 20% on 25% of their taxable income for the portion of taxable income not exceeding RMB 1 million (effective CIT rate of 5%).

In addition to the current policy, MSE will now enjoy a further 50% reduction on CIT liability for the first RMB 1 million taxable income. That is to say, MSE’s before-tax profits under RMB 1million will have their tax liability reduced by half.

MSEs are defined as those enterprises with taxable income less than RMB 3 million, the number of total employees not exceeding 300 persons, total assets not exceeding RMB 50 million, and not engaged in industries prohibited or restricted by the government.

See the below example for the CIT calculation under the new policy for MSEs.

Super deductions for R&D expenses

Enterprises in China engaged in Research and Development activities have in the past enjoyed Super Deductions for their R&D expenses for CIT purposes as a means of promoting innovation and technological development. R&D expenditure by qualified enterprises can enjoy an additional 75% expense deduction under the preferential policy (Caishui [2018] No. 99).

During the 2021 Two Sessions, Premier Li Keqiang announced that the additional 75% Super Deduction of R&D expenses by qualified enterprises shall be extended in 2021 and R&D Super Deductions for manufacturing enterprises shall be increased from 75% to 100%. This is to say, qualified manufacturing companies engaged in R&D activities can deduct R&D expenses at a rate of 2:1 per RMB of expenditure.

What to Expect in 2021

The year 2020 was certainly a tumultuous year for businesses across the globe due to the COVID epidemic, the impact of which was first felt in China. The Government Work Report describes major successes in implementing macro-policies to meet the urgent needs of market entities and keep the fundamentals of the Chinese economy stable – resulting in the Chinese economy expanding by 2.3% and being the only major economy to report GDP growth last year.

The 2021 Work Report promises to further optimize and implement tax reduction policies and, in the process, acknowledges that some policy adjustments may no longer be effective. The report promises to hedge against the impact of these policies and to deliver further tax reduction policies to meet the on-going challenges.

Additionally, the 2021 Work Report contains a GDP target of 6% – a modest target compared to many analysts estimating the Chinese economy could grow at a rate of 8% in 2021 . Premier Li stated during his address that the modest GDP target of 6% will “enable all of us to devote full energy to promoting reform, innovation, and high-quality development”.

Future reforms are expected to be in line with China’s 14th 5-year plan and the long-term goals for 2035 which place innovation, advanced manufacturing, domestic demand, and social and environmental goals at the forefront.

Along with renowned commitments made during the Two Sessions to continuing the Reform and Opening Up, foreign investors are likely to see more opportunities in China, especially in areas of technology, manufacturing, green energy, and trade.