Annual bonuses are an integral part of employee remunerations, partly due to a special policy allowing for the preferential tax treatment of one-time annual bonuses in China.

It’s very common for employees in China to receive a 13th-month salary, typically paid in February of the following year, as an annual bonus. It’s also not uncommon for employees to receive large parts of their total remunerations in the form of an annual bonus in profit-driven sectors such as software, tech, and manufacturing.

What makes annual bonuses a preferential method of remuneration is a special ‘one-off’ tax calculation method which can be applied once per year per employee. This preferential method allows for the taxation of annual bonuses to be taxed separately from the comprehensive income of the employee, often resulting in a net tax saving.

Starting on January 1st, 2022, employees and employers will no longer be able to apply this one-off preferential policy for the tax calculation of annual bonuses. Depending on the salary structure of the employee, some employees may see their net tax payable on their comprehensive income increase.

We will discuss the implications of the policy change for calculating annual bonus tax in China and how employees and employers can respond to the new policy in 2022.

Calculating Individual Income Tax on Annual Bonuses in China

With employees no longer able to utilize the ‘one-off’ tax calculation method for annual bonuses, employees and employers have fewer tools at their disposal for individual income tax planning. This is due to a 2018 announcement by tax authorities (Caishui [2018] No. 164) announcing the end of the preferential tax policy for annual bonuses enjoyed by all resident taxpayers in China starting January 1st, 2022.

Note: Employees who have not yet utilized their one-off special tax treatment for their annual bonus in the current year and wish to do so have until December 31st, 2021 to do so.

Preferential Annual Bonus Policy Ending in 2022

This special tax calculation method for annual bonuses introduced in 2005 (Guoshuifa [2005] No. 9) allowed annual bonuses to be taxed separately from the comprehensive income earned by taxpayers in China.

Taxing the annual bonus amount separate from the comprehensive income of the individual generally allowed for a lower tax rate to be applied depending on the income structure of the individual.

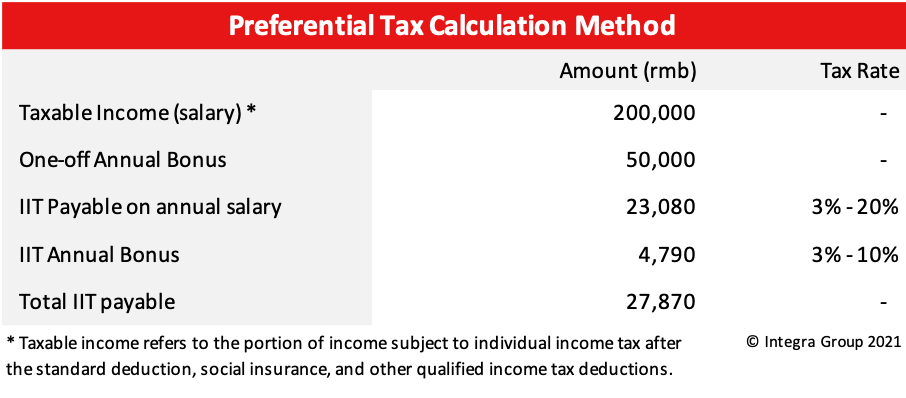

Individuals and withholding agents could apply the one-off calculation method for annual bonuses using the formula below:

Tax payable = (Annual Bonus amount * applicable tax rate) – quick deduction

Example 1: Preferential Tax Calculation Method

New Annual Bonus Policy

In a 2018 announcement, Chinese authorities announced a change to the tax calculation method for one-off bonuses. The announcement stipulated that one-off bonuses, including performance bonuses, retention bonuses, and other forms of one-off remunerations, shall be included in the comprehensive income of the individual (CaiShui [2018] No. 164).

In other words, the annual bonus will be taxed together with all other forms of income of individuals in China at the standard progressive tax rate.

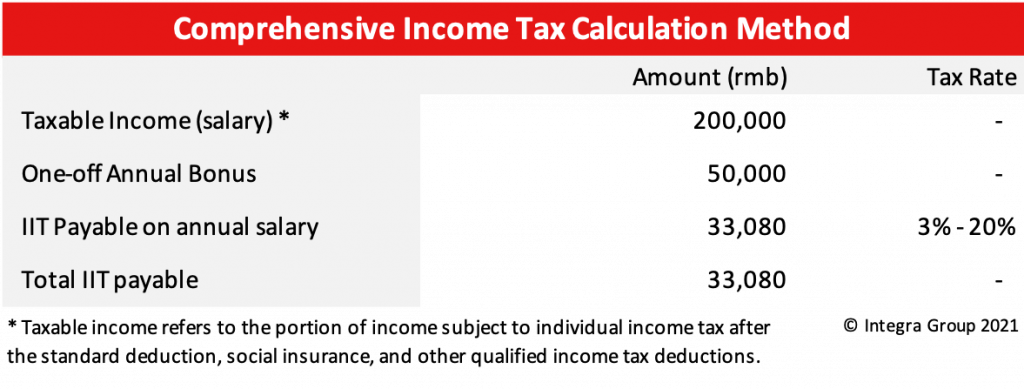

The formula for calculating income tax on comprehensive income is as follows:

Tax payable = (Comprehensive income * applicable tax rate) – quick deduction

Example 2: Comprehensive Income Tax Calculation Method

Comparing the new and old policy

In previous examples 1 and 2, the taxable income and annual bonus are equal. However, under the new comprehensive income tax calculation method in example two, the net tax payable is RMB 5,210 higher. In other words, the total tax payable increased by 18.69% under the new policy.

How to prepare

With the individual income tax payable on annual bonuses likely to increase for many employees in China, employers and employees should first identify which party is liable for the tax payable. If the employment contract stipulates a before-tax salary amount, the tax burden lies with the employee. In turn, if the employment contract stipulates an after-tax amount, the tax burden lies with the employer. Employers and employees are going to shoulder any changes to the new tax payable under the new policy going forward – whether it be a net positive or negative for the individual’s take-home pay.

Nevertheless, bonuses still have an important role to play in incentivizing on-the-job performance, retaining employees, profit-sharing, and rewarding employees and are thus unlikely to fall out of favor with employers. However, without their special tax status, annual bonuses are now on equal footing with salaries.

It’s likely that given the opportunity, many employees would choose an increase in their fixed salary over the same amount being paid together with the annual bonus. Come 2022, new hires and employees renegotiating labor contracts may begin targeting a higher fixed salary over a larger bonus.

For now, employees who have not yet utilized their one-off special tax treatment for annual bonuses for the current year, are still able to do so before December 31st, 2021.

Starting January 1st, 2022, employees and employers are going to have to shoulder any changes to the new tax payable under the new policy as they now have fewer tools at their disposal for tax planning on part of the employee.