China has the largest labor market in the world and has long been a strategic location for many manufacturers and labor-intensive industries to set up operations. However, as the Chinese economy continues to grow and wages rise, so does the cost of hiring employees in China.

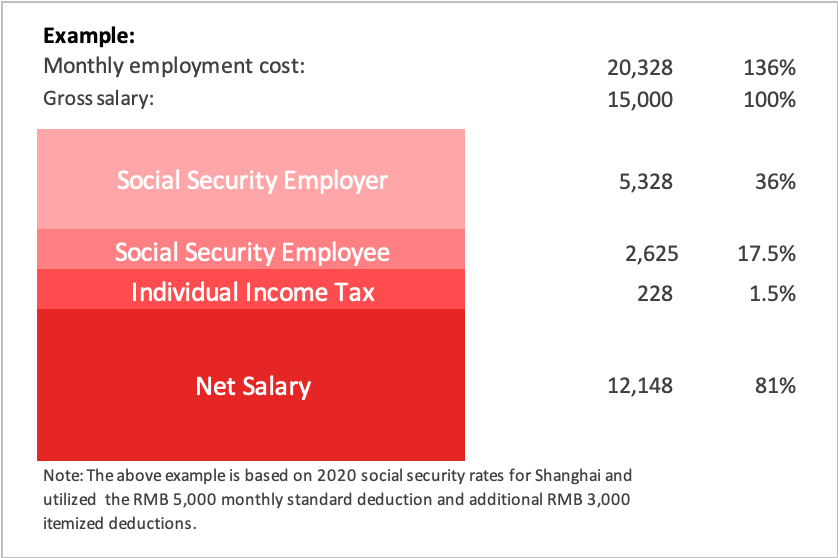

The cost of hiring employees in China consists primarily of mandatory expenses such as employee’s gross salary and social security contributions. It is also common practice in China to provide other incentives and bonuses to employees based on performance or other criteria – though this is entirely up to the discretion of employers.

When considering the total cost of hiring employees in China, employers should first determine the gross salary using fair compensation for similar work in the designated city. Factoring in the various additional costs borne by the employer – such as mandatory social security benefits – and other voluntary benefits, employers can then begin to see the total cost of hiring employees in China.

Compensation and Benefits (C&B)

C&B is typically divided into three parts: wages and salary, incentives and bonuses, and mandatory social security contributions.

- Wages & Salaries are generally paid monthly and vary from 12-13 months. A 13th-month pay scheme is common practice – but not mandatory – in China, with the 13th month’s pay issued during the Chinese Spring Festival. Overtime pay according to PRC labor law is calculated as 150% of normal wages when performed on weekdays, 200% when performed on rest days (i.e. weekends), and 300% performed in public holidays.

- Incentives and Bonuses – are generally tied to individual performance and/or team/company overall performance. They can be paid monthly, quarterly, or annually and are normally not guaranteed. Examples include individual performance, team performance, profit sharing (payouts based on organizational profitability), comprehensive performance (awards based on the performance of the company, team, and individuals), sales bonuses, sales commissions, and special recognition awards.

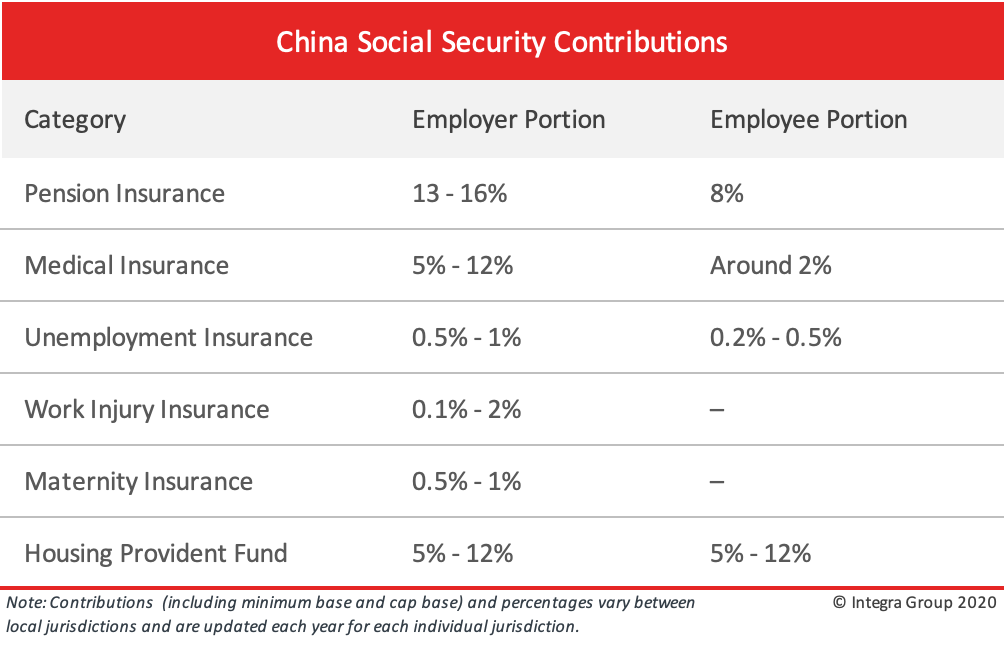

- Social securities – refers to the 5 social insurances and 1 housing provident fund. Social security contributions are mandatory for both employers and employees and comprise a significant portion of the total cost of hiring employees in China. Generally, the employer portion ranges between 35-40% of the employee’s monthly gross salary up to a fixed limit.

Normally the contributions are based on the employee’s average monthly gross salary of the previous year and are limited to Maximum Base and Minimum Base. The Maximum and Minimum bases are typically 300% and 40% of the local average gross wages of the previous years. They differ from city to city and are announced by the local government annually.

Individual Income Tax (IIT)

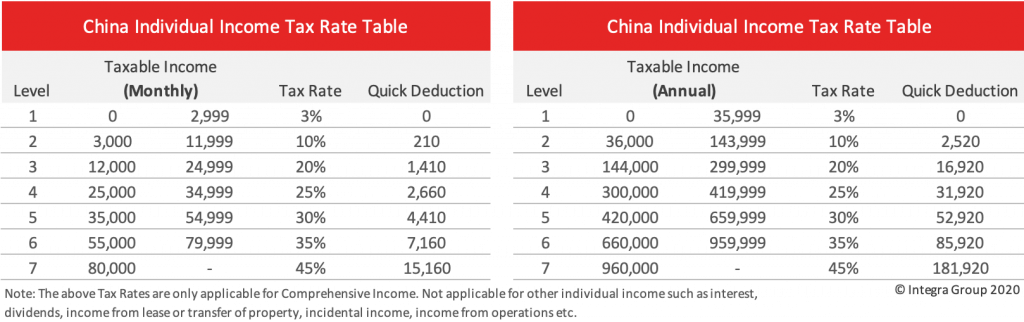

Individual income for wages and salary in China is taxed based on a progressive tax system with seven tax brackets ranging from 3%-45%.

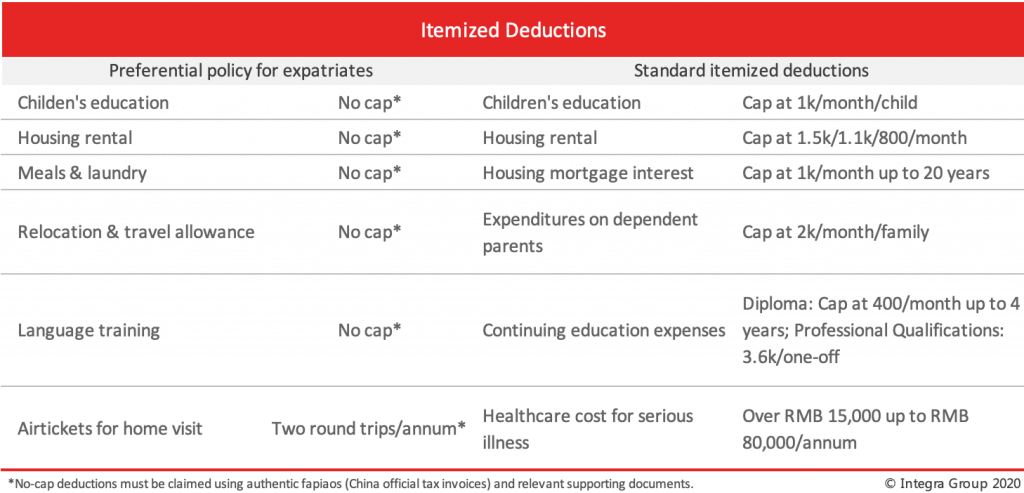

China tax residents are taxed on their gross wages and salary (including base salary, bonuses, allowance, etc.) minus the employee portion of the social security contributions and allowed itemized deductions. All China tax residents are also allowed an additional RMB 60,000 standard deduction per year.

Taxable Income = gross salary – employee social security contribution – standard deduction – additional itemized deductions – other allowable deductions

Expatriate employees currently enjoy more preferential policies when it comes to deductible expenses. Until December 31st, 2021, expatriates can fully deduct certain expenses items from their taxable income – without clearly defined limits. Starting in 2022, expatriates will no longer be able to enjoy the preferential tax treatment but can still utilize the standard itemized deductions available to all China tax residents.

IIT for expatriates

Expatriates who reside in China for cumulative 183 days or longer within a calendar year are considered PRC tax residents. After 6 consecutive years of PRC Tax Residency status, expatriate’s worldwide income will become subject to tax in China.

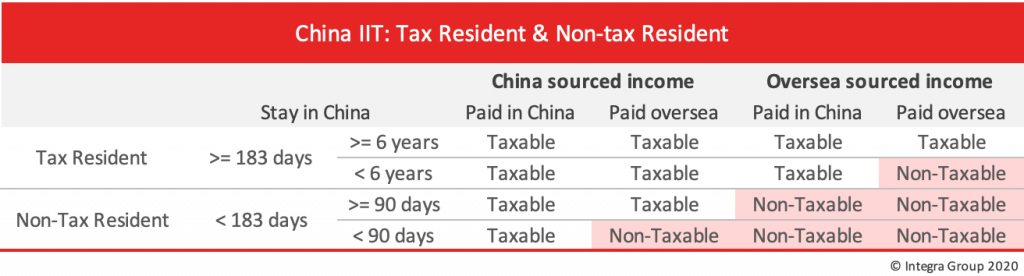

The table below shows the tax liability for expatriates in China based on various income sources;

Expatriate in China who wants to avoid subjecting their worldwide income to taxation in China, can reset the 6-year requirements by exiting China for more than 30 days consecutively or 183 days cumulatively in any tax year during a 6-year period.

According to regulations issued by The PRC Ministry of Human Resources and Social Security, expatriates must also pay into the mandatory social security funds in China. As of Dec 31st, 2019, China has entered into Bilateral Social Security Exemption Agreements with 10 countries providing exemptions from social security contributions for expatriate employees from these countries.

However, enforcement of social security contributions for expatriate employees varies between jurisdictions. In practice, many employers in certain cities choose to not make social security contributions for expatriate employees.

Holiday and Leaves:

Public holidays

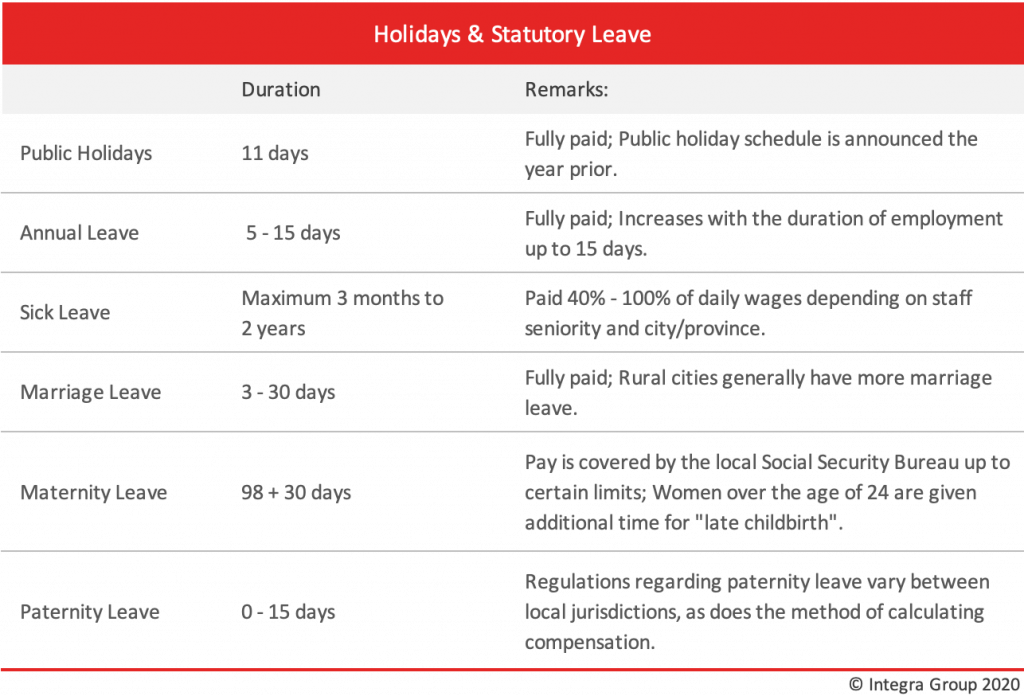

Public holidays in China are arranged according to both the Lunar calendar and the Gregorian calendar. The central government will announce, typically in November, the public holiday schedule for the following year. In total, there are 11 fully paid public holidays. In addition, the government will typically provide additional “rest days” following the Chinese Spring Festival and Mid-Autumn festival public holidays to extend the holiday. Employees should work one or two rest days (i.e. Saturday or Sunday) to make up for the additional time off given to them.

Annual leave

By law, the minimum fully paid annual leave granted to full-time employees is 5 days following one year of employment and increases with the number years of employment as follows – up to 15 days after cumulative 20 years of employment.

Companies may provide more paid time off as part of their company policy or personal benefits for their employees.

Sick Leave

Employees are granted a fixed number of paid sick days per year depending on the seniority of the employee. The minimum number of paid sick days and pay varies by city/province – generally a percentage of daily wages.

Other Paid Leave

According to China labor law, employees are also entitled to various paid leave such as marriage leave, pre-maternity leave, maternity/paternity leave, funeral leave. Summarized as follows,

Termination of Employment

Terminating an employment contract according to China’s Labor Laws requires employers to give 30-days prior notice and pay severance to the employee. Severance pay is generally equivalent to one month’s salary per year of employment with the company – or half month salary if the employee worked for less than 6 months with the company.

Companies can avoid paying severance if;

- Termination of a labor contract is mutually agreed upon; or,

- The employee is fired for violation of the labor contract (breach of contract provisions or disciplinary rules) with solid documentation and supporting evidence.

It’s important to note that labor disputes in China generally favor the employee. The burden falls on the employer to provide solid documentation and evidence to assert its right to terminate a labor contract. The penalty for wrongful termination is generally two times the amount of the original compensation.