Since the introduction of the OECD Base Erosion and Profit Shifting (BEPS) framework in 2015, countries have begun revising their transfer pricing regulations to be more in line with OECD guidelines. In 2016, China responded with the “Announcement on Improved Administration of Related Party Declarations and Contemporaneous Documentation (SAT [2016] No. 42, “Circular 42”] as the new prevailing regulations governing transfer pricing in China and related party transactions.

While China remains a key partner of the OECD and a member of the G20, there are key differences between Circular 42 and OECD BEPS framework for related party transaction disclosures.

Multinationals who regularly engage in related party transactions are encouraged to familiarize themselves with the requirements of Circular 42 and carefully review their transfer pricing practices regularly. This helps ensure that parties within the group can obtain reasonable profits without violating the arm’s length principle and maintain compliance with other local transfer pricing regulations.

Transfer Pricing Documentation in China

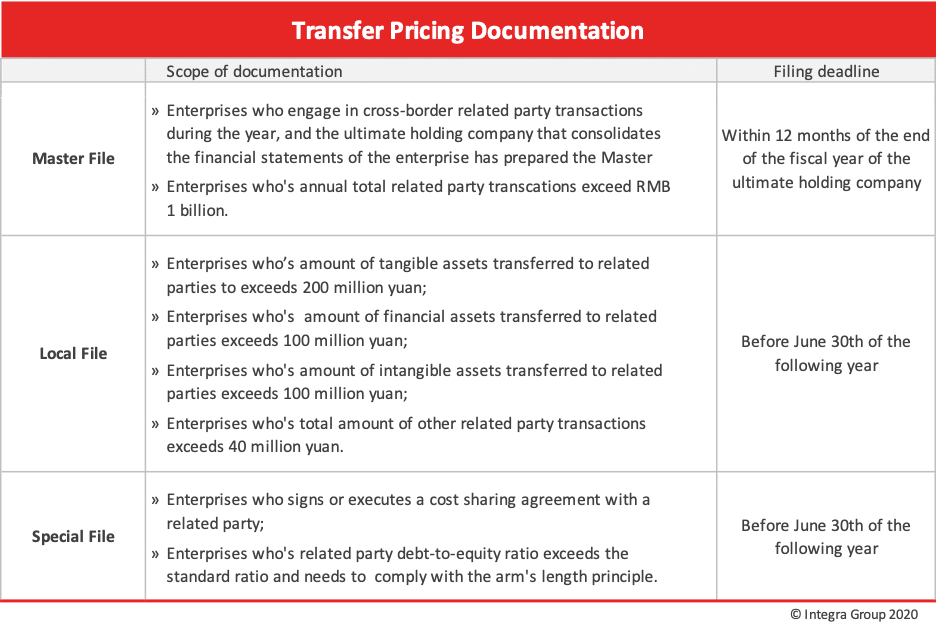

Circular 42 provides a three-tiered framework for transfer pricing disclosure for companies that meet different thresholds for intercompany transactions; known as the master file, local file, and special file. Enterprises must prepare the relevant documentation and make relevant disclosure before the filing deadline set forth in Circular 42.

Furthermore, tax authorities in China reserve the right to request additional transfer pricing documentation which are deemed relevant. The enterprise must provide additional documentation within 30 days upon request by the tax authorities.

Enterprises that engage in related party transactions, regardless of the annual related party transaction amount, are required to prepare transfer pricing contemporaneous documentation at the time which the related parties enter into the transaction. It’s important that documentation demonstrate the arm’s length pricing and the justification of transfer pricing methodology, such as reasoning and assumptions supporting the selected transfer pricing methodology.

Integra Group has found that multinational companies often struggle to provide sufficient supporting evidence for their pricing methods on their own as they often overlook the importance of accurately benchmarking their service prices against the market. This creates the risk of using speculative pricing methods which can lead to tax authorities making reasonable adjustments to taxable income for transactions that are judged to be outside of arm’s length.

It’s important that enterprises entering into such agreements implement systemic transfer pricing policies at the group level to review pricing and ensure the completeness of supporting documentation. This helps reduce a large workload at the end of the year should the business need to review its documentation or make year-end transfer pricing adjustments.

Year-end Transfer Pricing Adjustments

Multinational companies will commonly perform an annual year-end assessment of all their related party transaction. This helps to ensure that transactions are within arm’s length and allows the company to make any adjustments in a timely manner. Year-end adjustments are not uncommon as companies may want to adjust their transfer pricing for multiple reasons, such as if the profitability of the company has changed significantly or the company finds there is a special tax adjustment risk stemming from its related party transactions.

Companies can do what is called a voluntary adjustment during the annual tax reconciliation period. The company may submit a voluntary adjustment to tax authorities to adjust its taxable income if necessary. It should be noted that the voluntary tax adjustment creates the risk of double taxation for the group – as special tax adjustments made in China can typically not be used as input deductions by the related party overseas.

Furthermore, while completing a special tax adjustment voluntarily is seen as the correct action for companies to take when it finds special tax adjustment risks, however, it does not preclude the company from a special tax investigation by authorities.

Ensuring Transfer Pricing Compliance in China

As China has been a major recipient of FDI in recent years, it has experienced the many highly speculative tax evasion and avoidance strategies and tactics that multinational companies use to lower their taxes in a given tax jurisdictions. Authorities in China hold the view that transfer pricing activities are of major importance and have been stringent on disclosures of transfer pricing issues in the fight against the base erosion and profit shifting.

Thus, it’s important that companies with related party transactions regularly conduct transfer pricing analysis, regardless of the total transaction amounts, and take a group-wide approach to transfer pricing strategy.

Additionally, it’s important to ensure the documents on which are relied upon demonstrate the arm’s length pricing and the justification of transfer pricing methodology, including the reasoning and assumptions made to support the selected transfer pricing methodology. This helps reduce the risk of non-compliance and tax authorities making adjustments to taxable income for transactions which are not carried out at arm’s length prices, which will incur additional penalties and interest for the tax shortage incurred by the company.

Single function companies – such as sole manufacturers, distribution companies, or research companies – are also encouraged to implement additional year-end transfer pricing reviews. This is to ensure any the company does not incur unreasonable losses and can make any necessary year-end adjustments in a timely manner to help avoid a special tax audit.

In many cases, multinationals in China do not or cannot create the transfer pricing documentation themselves to support their related party transactions. Third parties are well suited to help companies prepare transfer pricing agreements and help ensure they are carried out at arm’s length.

Integra Group assists companies of all sizes to develop systematic transfer pricing strategies at the group level and prepare transfer pricing documentation. Businesses are encouraged to seek the help of a professional if they have any concerns about the compliance status of their business or would simply like to improve your compliance procedure.